AT&T Net Worth in 2022

About AT&T Net Worth

If you’re wondering about AT&T net worth, you’re not alone. This diversified global leader in telecommunications, media, and entertainment has a net worth of $147.55 billion. While the amount is subject to change, it’s clear that AT&T is doing well financially in the United States and around the world. If you’re considering investing in the stock, you should consider the company’s size and potential for future growth AT&T’s net worth is $147.55 billion. If we’re talking about the top companies in the world, AT&T certainly ranks high on our list. Founded in 1876, it has the longest fixed-line phone service in the world. While it is not known for a stellar stock market performance, its business does have some good points. The company has become one of the world’s largest telecommunications companies through mergers and acquisitions.

Also Read: ASML’s Net Worth

AT&T is a Diversified, Global Leader in Telecommunications, Media and Entertainment

A global leader in telecommunications, media, and entertainment, AT&T has a rich history. From its humble beginnings with Alexander Graham Bell’s telephone, to its emergence as the first truly modern media company, AT&T has changed the way we live and work for 144 years. Today, it distributes popular content through its WarnerMedia consumer brands. With the acquisition of Discovery, it will create a global entertainment company that is 71% owned by shareholders.The company continues to focus on building customer relationships by increasing fiber footprint penetration. It is on track to add 1 million fiber subscribers for the fourth consecutive year. The company recently announced deliberate price increases for select legacy wireless plans. The company is also focusing on reducing costs, and it remains on track to meet its target of reducing costs by incremental $1 billion this year. The company has consistently outperformed its peers and is well-positioned to keep pace with market changes.

Most Ethical Company in the World

In addition to delivering superior customer service, AT&T strives to be the most ethical company in the world. The company was named the World’s Most Ethical Company by Ethisphere for three consecutive years and is the only U.S.-based telecommunications company to appear on the list. Ethisphere recognized 136 global companies across 45 industries and 22 countries.

The company plans to increase its dividend payout ratio to forty percent to 43 percent per year on $20 billion+ in free cash flow. The company plans to repurchase shares if its Net Debt to Adjusted EBITDA ratio falls below 2.5x. AT&T hired Perella Weinberg Partners and Wachtell Lipton Rosen & Katz as financial advisors for this deal.

Also Read: The Net Worth of Comcast Corporation

Financial Results for the First Quarter of 2022

AT&T is due to report financial results for the first quarter of its 2022 fiscal-year on April 21. As a consumer, you should be interested in its growth areas, debt levels, and cash flow. If you are an investor in AT&T’s subsidiaries like Warner Bros. and Discovery, then the data on HBO subscriber counts should be interesting to you.Analysts are expecting AT&T to announce a strong cash flow during the first quarter. Specifically, AT&T expects to generate operating cash flow of between $40 billion and $41.5 billion during the first quarter of its fiscal year in 2022. The company’s management is also likely to stress the importance of connecting people, devices, and systems with wireless service. This is an area that has seen tremendous growth for investors, especially with the rise of the Internet of Things.

While total revenue grew by 2.1 percent during the first quarter, net income and adjusted EBITDA were down. Total broadband net additions reached 229,000, which was the highest quarter in more than a decade. Fixed wireless net additions totaled 194,000, while 35,000 of those were driven by Fios Internet. AT&T also reported a strong revenue growth in postpaid services, with retail postpaid churn at 0.83 percent.In addition to financial results, AT&T also plans to release its F2022 Financial Outlook on May 12. This document contains forward-looking statements, which are not guarantees of future performance. However, these forward-looking statements are based on various assumptions, expectations, and other factors that management believes are reasonable. In addition, it is important to remember that the company cannot guarantee future results or actions.

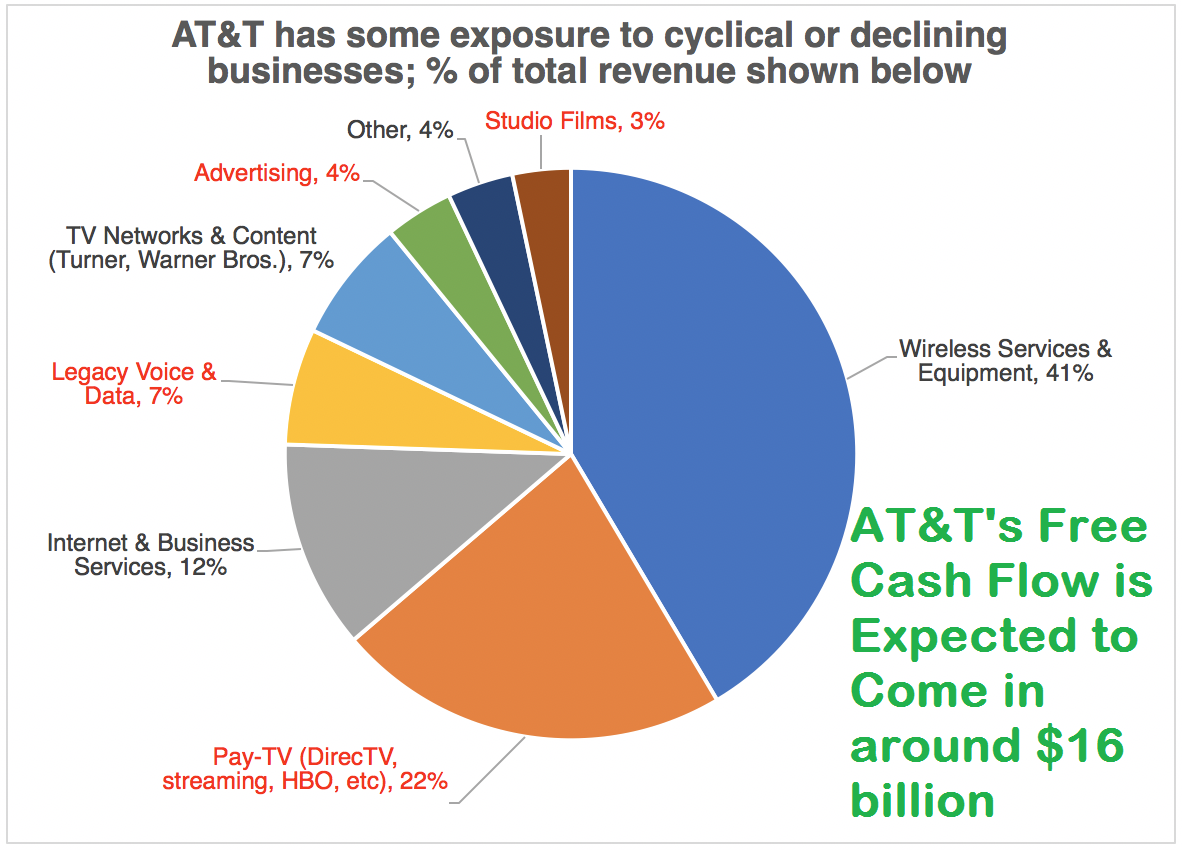

AT&T’s Free Cash Flow is Expected to Come in around $16 billion

This year, AT&T plans to spend $5 billion to deploy 5G spectrum in the U.S. and has a $24 billion capital spending plan for the next few years. The spinoff of WarnerMedia will also impact free cash flow, but the core wireless business will continue to be a cash machine. This year, AT&T expects free cash flow to dip to $15 billion before recovering to around $20 billion by 2023. It also expects to pay out $20 billion in dividends to its shareholders in 2023.In addition to boosting free cash flow, AT&T will focus on reducing debt. The company has prioritized paying down debt in recent years and announced a number of asset sales and other deleverage initiatives. This will negatively impact its dividend in the short term but pave the way for growth dividends in the future. But this dividend cut isn’t a deal-breaker. It may even help shareholders’ long-term financial outlook.

The company will continue to use its consistent go-to-market strategy to attract additional customers. In postpaid voice net additions, the company led the industry in 2021. Moving forward, the company expects to add more customers in the future as it continues to tap into under-penetrated segments of the mobility market. Furthermore, the company expects to benefit from the migration to unlimited plans, such as unlimited Elite, which has a higher ARPU than other plan types. The company expects to invest around $24 billion in capital in 2022 and 2023. However, it will continue to focus on growing its network through 5G. The company also expects to spend around $24 billion on capital projects in 2023, down from $20 billion last year. Additionally, the company expects to invest $24 billion in new infrastructure. AT&T is also expected to continue its investment in 5G spectrum.

Also Read: Net Worth of Roche Holdings

AT&T is a Slow Growing Company

As a dividend-paying telco, AT&T is a buy. Given the company’s low growth, AT&T has lowered its dividend payout ratio from an 80%-90 percent range in 1998 to just 72% today. Moreover, the company’s profits are only growing at a modest 2%-3% a year, making it an excellent choice for dividend-addicted investors. And even if AT&T is a slow-growing company, its dividend will provide over 50% of the income investors need to live on.Although AT&T isn’t a growth stock, it’s making the necessary changes to retain its current customer base and grow modestly. The company has already declared a $1.11 dividend, which is expected to boost its earnings by about 4% in 2020. AT&T’s revenue also fell by 13.3% in the first quarter of 2021, mostly due to the divestiture of businesses. However, the company’s standalone revenue increased from $29.7 billion in Q1 2021 to $29.7 billion in Q1 2022, a modest 2.5% growth rate.

The company isn’t growing quickly, and its stock is having its worst year since the financial crisis hit in 2008. Its multi-billion dollar bets aren’t paying off, and its wireless business hasn’t adapted to the changing times. However, it’s been on a buying spree lately, acquiring smaller media companies to maintain its presence in the media sector. It recently acquired the controlling stake in Otter Media, and it recently bought AppNexus.While AT&T is optimistic about its results, executives know the future of the company depends on major structural changes. The merger between AT&T and Comcast is expected to close this quarter, and the combined company will likely have lower debt than before. When the merger is final, AT&T is expected to cut its debt in half. In the meantime, it may be a slow-growing company, and investors will be watching closely to see how it continues to show growth.

For more Articles visit: Valid Words